Last Updated on October 28, 2024 by Ellen

Last Updated on October 28, 2024 by Ellen

When people find out I am an early retired, long-term traveler, they often say, “Wow, I wish I could do that.” To which I usually respond, “you can…” if you take a few key early retirement steps.

Then comes a reason or two or more why that certain individual can’t retire and wander the planet as my wife and I do.

Reasons people avoid early retirement steps

There are a handful of explanations which I hear over and over — all of which I understand:

- I’m years away from retirement age

- I don’t have enough money saved

- I have young kids (or aging parents)

- Myself or a loved one is dealing with health issues and insurance

- I have a mortgage to pay off

- I have other bills and financial obligations

Every one of those is a valid reason why someone can’t just quit their life and run off into the sunset – much as they would like to.

But guess what? Whatever your situation is at this moment, it is guaranteed to change as time moves forward. And with some effort and dedication, you can, in large measure, direct and craft that change so that at some point you are able to enjoy a retirement of leisure or travel or hobbies or whatever you desire.

Moreover, if you simply wait until all of life’s ‘pieces’ naturally fall into place, you are setting up for a full-retirement age exit from the workforce – age 65 to 67. At which point you will likely be unprepared, unable, or rushed to start your retirement dream.

With that as background, here are the first four steps to early retirement anyone can do starting right now to begin the process of living the life that you dream of.

First 4 steps to early retirement you can do right now

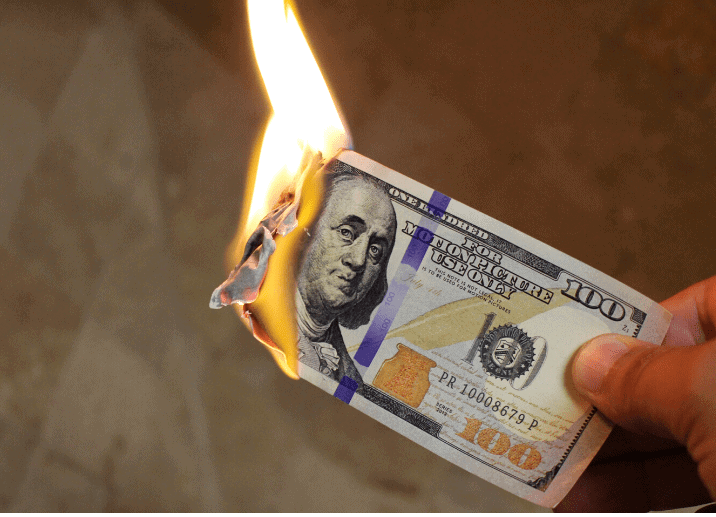

1. Address your spending

First, you MUST have a complete understanding of exactly what you are spending. Obviously, controlling that spending is the end goal. But you can’t reasonably decide on controls until you can account for every dollar you spend. So start there.

Do you know what you spend each day? Week? Month? Year? Have you ever kept track of every cent? Do you have a budget? Are you living within your means? Do you even know? You better figure it out.

Many Americans don’t know. We are blessed/cursed that way. You spend what you need to — and then a little more. You want something, you buy it. Cash, credit, payments – whatever you have to do. It’s a nice lifestyle. Until you want to do something else. Then you don’t have the resources, the savings, the equity, the ability to live any other way (except by taking on debt).

To have any decent retirement, you must balance what you are spending with whatever sources of income you will have. If you hope to retire early or have a higher quality lifestyle in retirement it is even more crucial — excess income is needed for savings. Either way, starting to understand and address spending today will help make whatever future retirement you have better.

2. Get control of your health

How many times have you sworn to lose weight, exercise, stop smoking, eat healthy, get more sleep, whatever else? Why haven’t you?

Are you really unable to make the lifestyle changes that are necessary to take control of YOUR body and health? Sure, it’s hard. It takes effort and dedication and perseverance. But we all know people who have succeeded – probably even you, before you backslid. Get it done! Finally.

What is the alternative? Assured poor health in your senior years and an inability to do what you want? What you do with your body right now, and every day going forward is critical. The aging process is unavoidable. There will be health issues. But retirement will be a lot less pleasant if you are overweight, reliant on drugs, or needing frequent medical care from the very beginning. And travel may be near impossible.

3. Teach your children financial responsibility

Yes, your kids in school prevent you from selling-out and moving on right now. But five to 10 years from now, they will be gone – and making children of their own. That is IF you haven’t raised financial illiterates who will still require your assistance.

Start teaching your kids about responsible money practices and management. The earlier the better. If you don’t know how, read some books, blogs, watch videos, take an online course. Implement what you learn. Make your kids more financially savvy than you are!

This too requires time and patience and discipline. No one can help you with that. But again, your future, your retirement, hinges in some way on the success of your children with money. The more they know, the sooner they will be ‘off your payroll’ enabling you to do what you want.

Similarly, help get your parent’s financial house in order. It is awkward, uncomfortable, and necessary. A valid will/trust and medical and financial power of attorneys must be created.

Involve an estate planning attorney and beneficiaries. Only deal with a qualified estate planning lawyer in the state of your parent’s residence. Unfortunately, like cute kids, elderly parents will move on. Avoid surprises and make the inevitable as painless as possible to your retired life.

4. Get rid of something

Think of all the stuff that you own. Look around your basement or attic or garage – or god forbid, that storage locker you are paying monthly to rent. How much do you need? What is the plan — to be buried with your belongings like a Pharoh, ready for the next life?

Here’s an actionable idea. While you are looking around at all that junk, pick up something you haven’t used for a year or more, dust it off and post an ad on Craigslist or eBay, and then collect $25 or $50 or $100 for it. Better yet, do that with two, three, four items. Do it every month. Get rid of that crap.

It’s all got to go sooner or later. At some point you will decide to downsize – and eventually, you’ll be downsized into senior care or your cemetery plot. Your clutter will be useless (sorry, Pharoh). Getting a jump on clearing stuff out is wise and cathartic and profitable too.

Are you ready?

Hopefully, reading these first four steps to early retirement will motivate you to act.

My own early retirement was the result of years of planning and deliberate decision-making and actions which allowed me to walk away and pursue my dream of endless global travel starting four years ago at age 52.

I have no doubt that waiting until I was closer to “official” retirement age to start adjusting my lifestyle would mean I’d be at work tomorrow morning and beyond. No thanks!

Further, regardless of how your retirement timetable or plans actually work out, developing responsible, healthy and frugal habits now will pay off (literally) as you move into the post-work phase of your life. These initial four steps to early retirement mentioned above are sure ways to start.

Good luck. I hope to see you soon on the beach.

As always, happy trails & more beer. Life is now!